Have you reviewed your beneficiary designations in your retirement account lately?

No one likes to think about their own mortality. But as you build your savings for your retirement you should ensure that those funds convey smoothly to your surviving family members (after you have had a long and very fulfilling retirement, of course).

We may not have the ability to control many aspects of life, but one thing we can control is what happens to our assets should something unfortunate happen to us.

At Lehigh, there are two benefits which require a beneficiary designation: the Lehigh University Retirement Plan accounts and life insurance. Today, we’re talking about your retirement plan accounts, which are administered by TIAA.

Who can be a beneficiary?

Generally, you may designate anyone to be a beneficiary: a spouse, partner, sibling, parent, friend, organization, or your estate, to name a few options. This is a very personal decision that you should consider carefully.

If you are married, your spouse must be designated as a primary beneficiary to receive at least 50% of your TIAA account benefits. You may drop this designation to below 50%, however, your spouse will need to sign a waiver relinquishing their rights to those funds. The TIAA website will prompt you with the directions to download and submit the waiver accordingly.

Additional information can be found in TIAA’s FAQ section within their website.

New Contracts Need New Beneficiaries

You may think you have your beneficiaries all sorted out in your TIAA accounts, but if you haven’t reviewed them in the last two years, you definitely need to. That’s because in early 2017, Human Resources announced that new Retirement Choice and Retirement Choice Plus contracts would be issued along with additional investment options.

When the new contracts were issued, your beneficiaries were not automatically carried over from our previous contracts. That means your older accounts will have beneficiaries but the accounts created under the new contracts won’t (unless you have gone onto the TIAA site and updated your beneficiaries since then).

We highly encourage you to take a few moments to go into your TIAA account and review your beneficiary information. Make sure you have beneficiaries designated for each contract/account and that the information is up to date for each contract listed in your account.

How to Update Your Beneficiaries

How to Update Your Beneficiaries

- Log into your TIAA account at www.tiaa.org/lehigh.

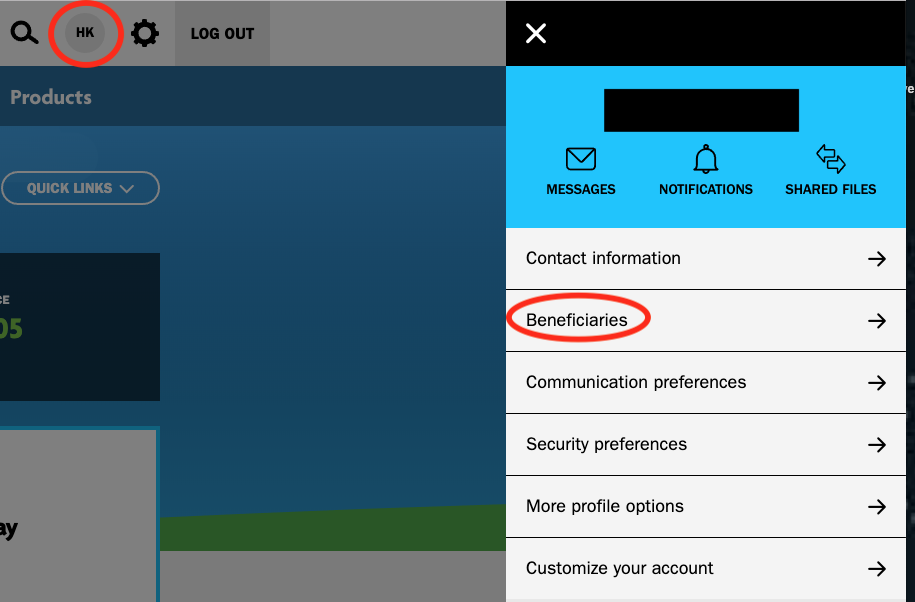

- Select your account preferences by clicking the circle with your initials in the upper right corner of the page.

- Select Beneficiaries.

- Review the beneficiaries on file; if you need to make changes, this can be done by selecting “Actions” next to each contract.

Important: Each of the Retirement Account contracts need to have designated beneficiaries assigned to them.

In the coming weeks, Human Resources will be sending additional information out to campus on computer lab hours in which staff and faculty members can drop by for in-person assistance for updating beneficiary information. Keep a lookout for further information. If you prefer making any necessary changes sooner and have questions on the process, you may always contact TIAA at 800-842-2252.

Remember: if there is one thing we can all be sure of, it is that life is unpredictable. But you can take control of how your retirement assets are handled. The first step is to review and/or add beneficiary designations to all of your Lehigh retirement accounts.