Since the university launched its new retirement plan in January 2014, staff and faculty have stepped up involvement in their own financial futures in a big way. As we reported last year, participation in the voluntary savings plan has increased nearly 80 percent.

Since the university launched its new retirement plan in January 2014, staff and faculty have stepped up involvement in their own financial futures in a big way. As we reported last year, participation in the voluntary savings plan has increased nearly 80 percent.

Some employees are taking an even greater role in the success of the new plan. Members of the Lehigh community with skills, training and experience in finance and investment management have been invited to serve as members of two key oversight committees for the plan. We thought it would be helpful for you to know more about how the Lehigh University Retirement Plan is governed.

The Basics

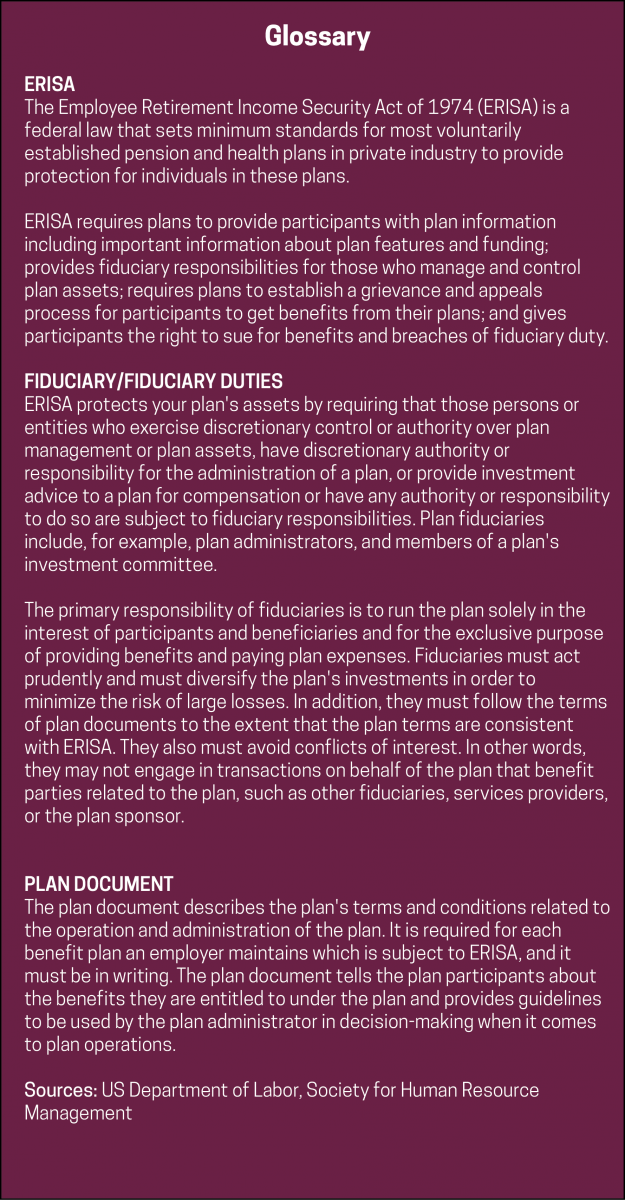

The Lehigh University Retirement Plan is an ERISA-compliant plan that includes Lehigh’s base contribution plan to each employee as well as a voluntary plan to which employees may contribute and receive additional matching funds from Lehigh as an incentive.

The plan’s documents and federal law dictate how the plan is governed. There are four main bodies that have some portion of responsibility for the plan: The Board of Trustees of Lehigh University, Lehigh University’s Human Resources Office, The Plan Administration Committee, and the Plan Investment Committee.

Members of the Plan Administration and Plan Investment Committees are hand selected by the Vice President of Finance and Administration and the President.

The Plan Administration Committee

The role of the Plan Administration Committee is to ensure that Human Resources’ administration and management of the plan is in compliance with the plan document and the federal Employee Retirement Income Security Act of 1974 (ERISA). The committee serves as a named fiduciary of the plan with respect to these duties.

The Plan Administration Committee monitors TIAA-CREF to ensure they are meeting the requirements of their role as Lehigh’s plan vendor. They make sure that TIAA-CREF and Human Resources are getting information such as annual reports and summary plan documents out to employees in a timely manner.

The committee reviews the plan audit and tax returns that Human Resources submits to the IRS annually. They also select the ERISA attorney Lehigh contracts with as well as other plan vendor and consultants.

In short, the Plan Administration Committee is responsible for ensuring that the Lehigh University Retirement Plan remains in absolute compliance with the plan document and the law.

The members of the Plan Administration Committee are:

The Plan Investment Committee

The Plan Investment Committee’s role is oversee the investments selected to be part of the Lehigh University Retirement Plan. As with the Plan Administration Committee, the Plan Investment Committee is also a named fiduciary of the plan.

The committee establishes and documents investment policies and objectives. It also reviews the menu of investments for investment performance, fees and expenses, and compliance with ERISA. It also has the power and duty to make changes to the investment menu based on the performance of the funds in the plan.

The members of the Plan Investment Committee are:

Human Resources

The Human Resources Office is responsible for carrying out day-to-day administrative functions related to the plan. This includes working with TIAA-CREF to ensure employee data is accurate. Human Resources oversees audits and tax returns for the plan. HR staff also strives to communicate to employees effectively about the retirement plan and works with TIAA-CREF to present investment and general financial literacy education programs.

The Role of the Board of Trustees

While the plan’s two committees have oversight responsibility, ensure compliance with applicable laws, and can make recommendations, no substantive changes to the Lehigh University Retirement Plan may be made without the approval of the Finance Committee of the Lehigh University Board of Trustees.

For More Information

- Each year, Lehigh is required to share an annual report on its retirement plan. This report is available in Spotlight.

- Lehigh University also provides the required Summary Plan Description on its HR website.