The new Lehigh University Retirement Plan, launched in 2014, is being implemented over a four-year period. Calendar year 2016 is year three of the implementation and brings with it two important changes.

Increased Matching Incentive

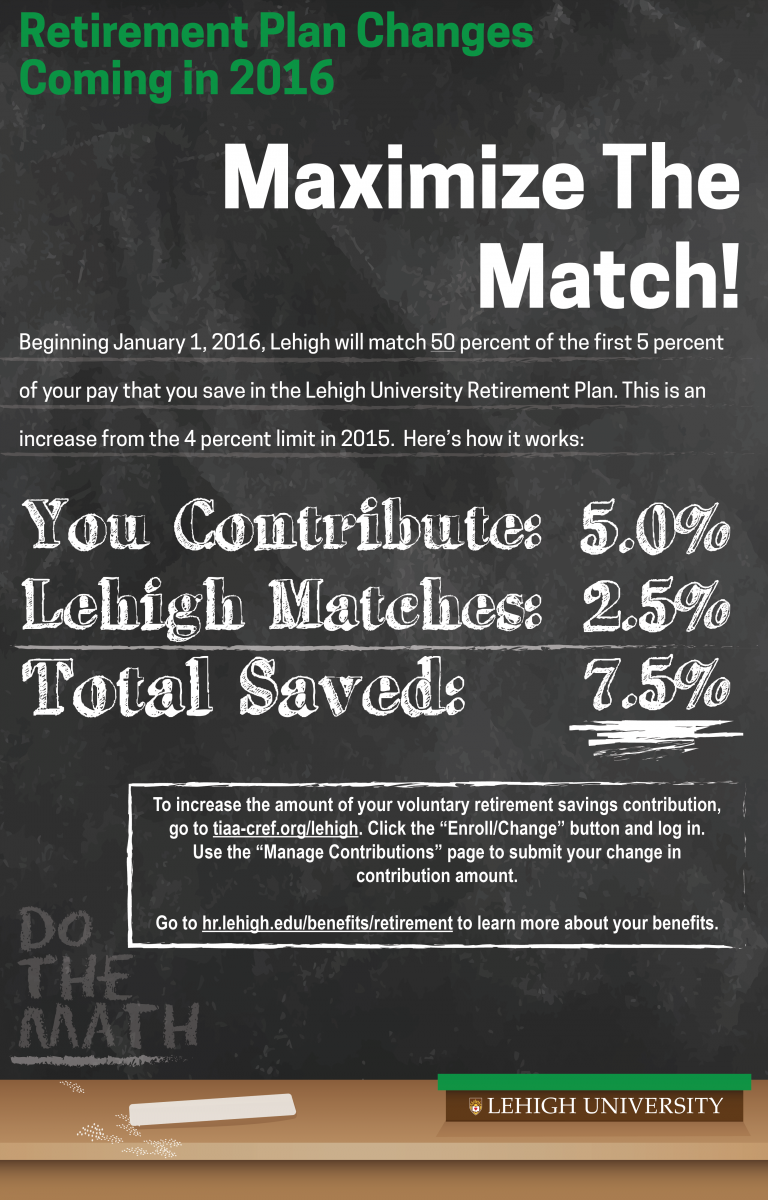

The new Lehigh Retirement Plan includes a matching incentive that is intended to encourage all employees to contribute toward their own retirement savings. The matching rate is one half percent for each one percent of income saved by you up to a specific limit.

The matching limit is being phased in over the four-year implementation period. By the fourth year, up to 6 percent of your voluntary contribution will be matched by Lehigh at a rate of 50 percent, for a maximum Lehigh match of 3 percent.

Next year, the matching limit will move from four (4) percent to five (5) percent of income, meaning the maximum Lehigh match will be two and one half (2.5) percent. To maximize your match, you’ll need to increase your voluntary retirement contribution if you aren’t already contributing five percent or more.

See our Maximize The Match graphic for more information.

For Staff and Faculty Age 30+ Employed at Lehigh Prior To January 1, 2014

The following change only affects employees age 30 and over whose first full time work day at Lehigh occurred prior to January 1, 2014:

As we told you during the introduction to the new retirement plan, Lehigh’s base contribution will be stepping down from 10 percent to 8 percent by the fourth year of the plan. The step down will take place at a rate of .5 percent per year. In 2015, the base rate moved to 9 percent. In 2016, that rate will move to 8.5 percent.

To learn more about the Lehigh University Retirement Plan, go to the HR Website and choose the page that applies to your employment status.

IRS Maximums Unchanged

The IRS imposes annual limits on contributions to tax qualified 403(b) retirement savings plans like the Lehigh University Retirement Plan. This year, the maximum amounts will not change. You can find a chart outlining the limits on the HR website.