Lehigh employees will receive a copy of the IRS form 1095 this year, as was also the case in 2016. You may have already received your 1095 from Lehigh. If not, you should receive it by March 2. We thought you might appreciate knowing more about the form.

Where did the 1095 form come from and why are we getting it?

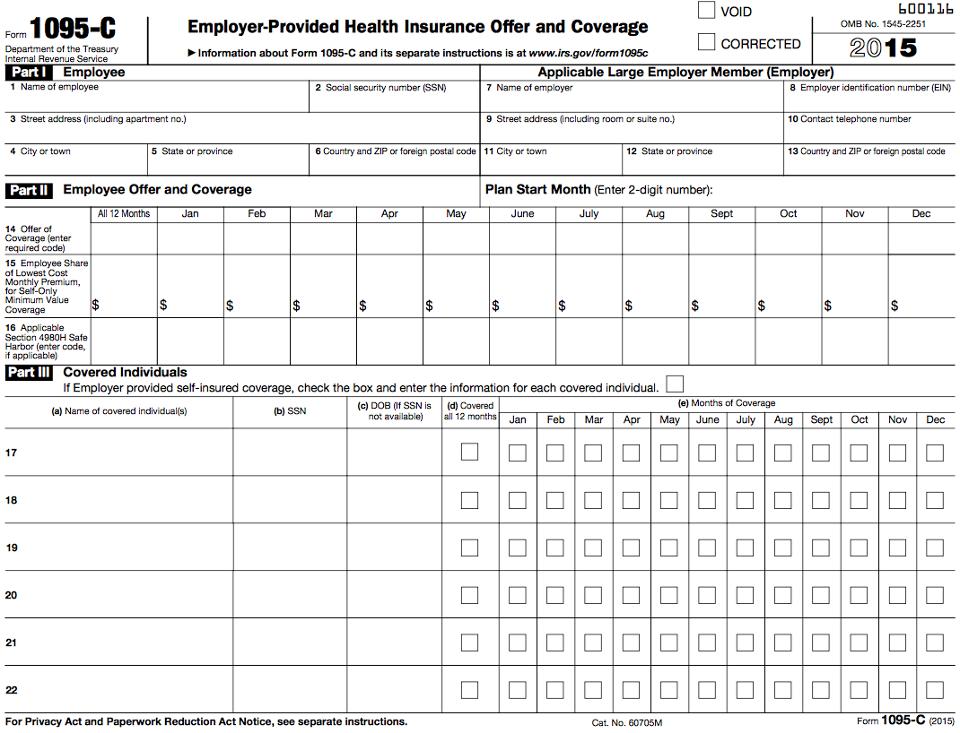

The 1095 was developed as part of the Affordable Care Act (ACA). It reports both to the federal government and to you about your health care coverage throughout the year. Because the ACA requires everyone to obtain health insurance or pay a penalty, Lehigh shares information about your (and your dependents’) coverage with the IRS via this form.

If the Affordable Care Act is repealed, do we still need this form?

Yes. The ACA was in effect for the entire year of 2016. IRS tax forms will still require you to report whether or not you had health insurance coverage in 2016.

Who sends the 1095 to employees?

As with your W-2 form, Lehigh is responsible for sending you this documentation.

What should we do with this form?

Keep the form with your tax records. When you file your 2016 income taxes, you will need to tell the IRS whether or not you had health insurance for each month of 2016. While you won’t need to include the 1095 form with your taxes, you should hold onto the form in case you should need to prove you had health insurance.

Is it possible to receive more than one 1095 form?

If you had health insurance through more than one employer during 2016, you may receive multiple forms. Keep them with your tax records in your files.

If you don’t receive a form…

If you believe you should receive a 1095 form but have not by March 2, 2017, contact Lehigh Human Resources at extension 8-3900.